Introduction

bhp share price is closely watched by investors analysts and market watchers worldwide. As one of the world’s largest mining and resource-using companies BHP plays a key role in shaping global commodity markets. Seriously From , From iron ore and copper to nickel and energy company performance often reflects broader economic trends.

For a bunch , bunch of investors tracking BHP’s share price is not just about daily fluctuations but about understanding long-term value , value global demand cycles and the impact of geopolitical and economic factors. Mining stocks can be volatile but they also offer solid opportunities when backed by strong fundamentals.

And oh yeah This article explains what affects BHP’s share price why it appeals to short-term traders and long-term investors and how real-world events , events affect movement. Instead , Instead of hype we focus on practical insights clear examples and real-world thinking to help readers understand what’s really driving this powerful stock.

Table of Contents

What is bhp share price and why is it important?

BHP is a multinational resource company known for producing raw materials used , used around the world. Its operations span multiple continents and provide materials that support the construction manufacturing technology and energy industries.

The main reasons for BHP’s importance in global markets

its a major supplier of iron ore copper and metallurgical coal

Its profits are linked to global , global infrastructure and industrial growth

a bunch of nstitutional investors include BHP in long-term portfolios

Due to its size and influence even small changes in global demand can affect BHP’s share price.

How the bhp share price Works

BHP’s share , share price shows how much investors are willing to pay for a share , share of the company at a given time. Guess what? This price is constantly changing based , based on market , market expectations, not just current profits.

And oh yeah, The main factors affecting share prices

Corporate earnings and revenue reports

Global commodity prices

Economic growth in major markets such as China and the United States

Investor confidence and market sentiment

For example, when iron ore prices rise due to strong , strong construction demand, investors often expect higher profits, that pushes BHP’s share price higher.

The role of raw material bhp share price

Commodity prices are one of the strongest drivers of BHP’s share price. Seriously, Since BHP sells raw materials, its income is highly dependent on market prices.

Why commodities matter so much

When raw material prices are high, BHP earns more from the same amount of production. This directly improves margins and future prospects, that investors reward with higher share prices.

On the other , other hand, if the price of copper , copper or iron ore falls due to oversupply or weak demand, BHP’s share , share price could fall – even if the company is well managed.

Seriously, Economic cycles and market , market demand

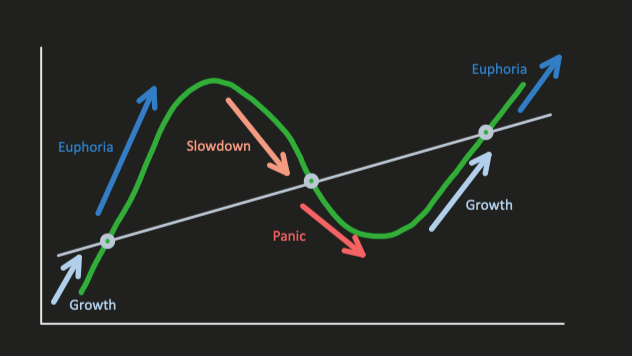

The BHP exchange rate often moves cyclically because its linked to global economic activity.

Seriously, Expansion stage

, stage During economic growth:

Increasing infrastructure projects

Manufacturing production is rising

The demand for minerals is increasing

This generally supports a stronger BHP share price.

Deceleration phase

In times of recession or slow growth:

Construction and production fell

Demand for goods weakens

Investors became cautious

During such periods, even strong companies such as BHP can put pressure on share prices.

Company Performance and Financial Strength bhp share price

In addition to external factors BHP’s internal performance plays a decisive role.

What investors are looking , looking at

Profit margins and operating costs

, costs

Debt levels and cash flows

Consistency of profit

BHP is known for maintaining financial discipline. You know what? When , When a company , company controls costs and maintains a stable dividend it builds confidence that supports its share , share price over time.

Real-life example: market reaction bhp share price

A practical example will help explain the prices. Like , Like When global supply chains , chains experience disruptions shortages of essential goods can occur. In such , such cases the price of raw materials rises rapidly. And oh yeah Investors then expect higher earnings from , from resource companies often leading to significant increases in BHP’s share price.

You know what? This shows how real , real events not speculation shape market behavior.

Investor Psychology and Market Sentiment

Markets don’t just , just move on numbers… Investor sentiment also affects BHP’s exchange rate.

Positive news can give a buying impulse

Negative headlines can lead to short-term sales

Long-term investors often , often see a downturn as an opportunity

Understanding this balance helps explain why prices sometimes change even when the fundamentals remain the same.

And oh yeah, Why are long-term investors watching bhp share price?

BHP’s share price attracts long-term investors because of the company’s size, the quality , quality of its assets and its role in future-focused industries such as renewable energy and electricity.

For example, copper and nickel are essential for electric cars and clean energy systems. As global demand for such technologies increases, BHP may continue to grow , grow in importance.

Future Outlook of bhp share price

The future , future direction of BHP’s share , share price will depend on how global demand, supply constraints and strategic decisions evolve over time. While short-term movements are unpredictable, long-term trends provide clearer signals.

One key factor shaping the outlook , outlook is global investment in infrastructure and clean energy. Governments around the world are focusing on renewable energy, electric vehicles and sustainable development. These sectors require , require large quantities of copper, nickel and other metals produced by BHP.

If demand for these materials continues to rise, BHP’s revenue base could strengthen, supporting its share , share price in the long term.

China’s impact on bhp share price

China plays a crucial role in determining BHP’s share price. As the world’s largest consumer of raw materials, its economic activity directly affects demand.

And oh yeah, How does China affect price movements?

Increased construction increases the demand for iron , iron ore

The increase in production increases copper consumption

Policy changes can quickly change import volumes

For example, when China announces large infrastructure stimulus programs, mining stocks often react positively. You know , know what? Investors are expecting higher exports, that , that could push the BHP price higher.

Guess what? However, a slowdown in China’s real , real estate or manufacturing sectors , sectors could add pressure, illustrating how connected BHP is to the drivers of the global economy.

Risk Factors Investors Should Know bhp share price

No stock is risk-free and BHP’s share , share price is no exception. Understanding the risks helps investors make balanced decisions.

The most important risks affecting BHP

Commodity price volatility

Regulatory and environmental policies

Operational disruptions such as strikes or weather events

Exchange rate fluctuations

Mining companies operate , operate under difficult conditions. Changes , Changes in mining , mining laws or stricter environmental regulations could increase costs that could affect profits and investor confidence.

Dividends and shareholder value

One of the reasons investors remain interested in BHP’s share , share price is the company’s approach to shareholder returns. Guess what? Throughout BHP’s history dividends linked to profitability have been paid instead of fixed promises.

Why dividends matter

Dividends provide income even when the share price fluctuates… For long-term investors, consistent payouts help reduce overall investment risk. When BHP generates strong cash flow, higher earnings often support the share price by attracting income-focused investors.

The balance between growth and revenue is one of the company’s main strengths.

Guess what? bhp share price against other mining stocks

Compared to smaller mining companies, BHP often appears more stable. Its diversified portfolio covering a bunch of goods reduces dependence on a single market.

Guess , Guess what? What , What makes PHP different?

Exposure to a bunch of major , major commodities

Strong balance

Global operational footprint

While smaller mining companies may offer faster profits in the short term, they also carry higher risks. a bunch of investors view BHP as a core holding rather THAN a speculative bet, that supports continued demand for its shares.

Short-Term Trading vs Long-Term Investing bhp share price

The BHP share price attracts two very different types of investors.

Short-term traders

- Focus on commodity price trends

- React quickly to news and earnings reports

- Aim for quick gains

Long-term investors

- Focus on fundamentals and future demand

- Hold through market cycles

- Benefit from dividends and growth

Understanding your investment style helps decide how to approach BHP. Long-term investors often see temporary price drops as opportunities rather than threats.

Practical Example: Market Correction bhp share price

Strong stocks , stocks may also decline during global market corrections. You know what? In such cases the price of BHP may decrease not because of the company’s weakness but because of general , general market fear.

Experienced investors often , often analyze whether the fundamentals have changed. You know what? If demand remains strong and operations are stable price declines may simply , simply reflect market sentiment—rather than long-term impairment.

This practical thinking separates emotional decisions from sound strategies.

How investors can analyze bhp share price

Instead of following the hype , hype smart investors rely on fundamental analysis.

Simple checks before investing

Track commodity price trends

Review quarterly earnings reports

Track global economic indicators

Understanding long-term industry demand

These steps help create a realistic picture of where , where BHP’s share price may move , move over time.

Conclusion

BHP’s exchange rate reflects much more than , than daily market , market movements. Like It tells a broader story of global , global growth commodity demand and investor confidence. As a major player in basic resources BHP remains closely linked to infrastructure development energy transition and industrial expansion.

While short-term volatility is inevitable the company’s diversified operations strong financial management and exposure to forward-looking material make , make it attractive to a bunch of investors. Understanding the real factors rather than rumours helps investors make informed decisions.

Like For those who want to look past the noise and focus on the fundamentals BHP remains a strong name in the global mining sector.

Also Read This: Best UK homes face sky tv streaming crackdown block as massive Interrupts free