Introduction

In recent years the world , world of quantum computing has moved from theoretical research to practical applications with companies such as dwave share price Systems leading the way. Known for its pioneering quantum annealing technology D-Wave has attracted the attention of investors technology enthusiasts and companies seeking advanced computing solutions. But in addition to technical innovations curiosity about its financial performance is growing.

D-Wave’s stock price has become , become a hot topic , topic as more and more people explore investment opportunities in quantum technology. Understanding your market value isn’t all about the numbers; its about harnessing the potential of technology to redefine industries from logistics and crypto to artificial intelligence and materials science. Like In this article we examine the factors affecting D-Wave stock market trends and what investors should watch out for.

Table of Contents

Guess what? Understanding dwave share price

Before diving into the details of the share price it’s important to understand the basic operation of the company:

Quantum , Quantum Computing Expertise: D-Wave focuses on quantum annealing systems that solve optimization problems more efficiently than classical computers.

Like Customers and Partnerships: Companies such as Volkswagen Lockheed Martin and NASA have partnered with D-Wave demonstrating the industry’s confidence in its technology.

You know what? Innovative product , product line: From the D-Wave 2000Q to the Leap quantum cloud platform the company is constantly updating its offerings to stay ahead of the quantum race.

Guess what? This strong foundation of technological and business cooperation provides the background for market performance influencing investor confidence.

What Influences dwave share price?

Unlike traditional technology companies, quantum computing companies like D-Wave experience stock price fluctuations influenced by unique factors:

Market perception and hype

Quantum computing is still in its infancy. Positive announcements about new results or partnerships could lead to significant increases in D-WAVE’S stock price, even before tangible revenue growth.

Guess what? For example: When D-Wave announced improved cloud integration for its quantum computers, there was a temporary spike , spike in market interest.

Industry competition

Companies such as IBM, Google and Rigetti is also developing quantum solutions. Investor sentiment often responds to perceived competitive advantages or underperformance relative to peers.

Financial performance

As D-Wave’s revenue streams grow, profitability continues to improve. The share price can reflect , reflect excitement about , about future potential and caution , caution about current financial stability.

Technological milestones

Any successful demonstration of the ability to solve quantum problems can increase investor confidence. Demonstrations of improved logistics or crypto solutions often generate positive market , market feedback.

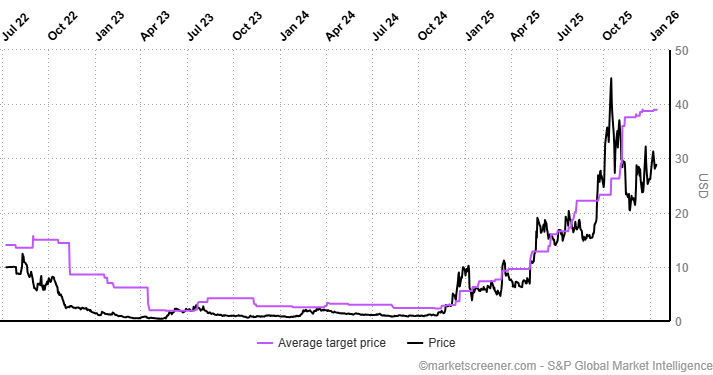

Recent Trends in dwave share price

Understanding historical and recent trends is key for investors:

D-Wave recently became more publicly available through a SPAC merger, allowing for wider trading.

Initial trading was volatile, reflecting the excitement and uncertainty of the quantum market.

Analysts point out that quantum computing stocks, including D-Wave, often behave differently than traditional tech stocks because of the futuristic nature of their products.

Key Notes:

Price movements are often driven by news rather than earnings.

Short-term spikes may occur after new contracts, partnerships or quantum breakthroughs are announced.

You know what? Long-term value is tied to the company’s ability to effectively commercialize quantum technology.

Investors looking into D-Wave should be prepared for high volatility and think strategically OVER the long term.

Real-life examples of the dwave share price effect

How quantum computing works , works helps put D-Wave’s stock price movements into , into context:

Optimizing Volkswagen Traffic Flow: D-Wave helped plan and optimize urban traffic patterns. This practical application demonstrates business value that goes beyond theoretical research.

And oh yeah, NASA , NASA research projects: Collaboration on quantum simulations of space exploration points to a broad future, that , that positively affects investor sentiment.

Use cases in the financial sector: Banks are researching D-Wave solutions for portfolio optimization, demonstrating the system’s inherent potential in high-risk decision-making.

These examples show that D-Wave’s market value is not only based on technology, but also on solving real problems, that often motivates the interest of investors.

Challenges Affecting Share Price

No investment is without risk… Seriously, For D-Wave, the most important challenges affecting the share price are:

Technological uncertainty: Quantum computing is the newest , newest technology, but its still experimental in a bunch of industries.

Market competition: Competitors such as IBM and Google may overshadow D-Wave’s solutions.

Regulatory and Security Concerns: Quantum technology has national security implications that may affect its adoption and funding.

Like, Volatility: Due to its position as a futuristic technology company, its share price can fluctuate based on hype rather than actual earnings.

Investors should , should balance their optimism about , about technological breakthroughs with practical financial analysis before making decisions.

You know what? Expert insights on dwave share price investing

Financial analysts suggest that D-Wave’s stock price should be viewed through a long-term lens:

High growth potential: Quantum computing is expected to grow significantly over the next decade.

Risk-Reward Balance: Volatility is likely in the short term, but early investors in successful quant companies stand to benefit greatly.

Guess what? The importance of strategic partnerships: Working with Fortune , Fortune 500 companies conveys credibility and increases the potential for sustainable revenue growth.

Analysts stress that while D-Wave stock may be exciting, it’s not a traditional technology investment and requires patience.

Projected Growth and Market Potential

The future , future of D-Wave’s stock , stock price is closely tied to the growth of the quantum , quantum computing industry itself. Analysts expect , expect the global quantum computing market to reach $15-20 billion by 2030 due to growing demand for optimization and integration of artificial intelligence and scientific research applications.

As a leader , leader in quantum annealing technology D-Wave is well positioned to benefit from this expansion.

The main drivers of growth

Cloud-based quantum services: D-Wave’s Leap platform enables , enables companies to access quantum computing without hardware opening up new revenue streams.

Industry Partnerships: Long-term contracts with companies in the automotive aerospace and financial sectors , sectors ensure sustained interest and potential revenue growth.

Innovation Pipeline: Continued research into quantum hardware and software can lead , lead to breakthroughs attract investor enthusiasm and drive higher stock , stock prices.

Investors tracking D-Wave stock should watch for announcements of new contracts partnerships and technical breakthroughs as these often trigger short-term market moves.

dwave share price Investment Strategies

Investing in quantum computing is not like traditional stock investing; It requires a strategic approach:

A long-term perspective

D-Wave technology is revolutionary but still in the early stages of mainstream adoption. For investors:

Expect high volatility and sudden price swings

, swings

Focus on long-term gains , gains instead of short-term gains

Watch industry adoption indicators not just , just stock prices

Diversification approach

Quantum computing is a high-risk high-reward industry. By diversifying your investments across , across a bunch , bunch of technology companies you can reduce risk while maintaining exposure to potential gains:

Combine D-Wave stocks with traditional tech stocks

Consider ETFs that focus , focus on high-tech or artificial intelligence

Track competitor developments to get a balanced picture

Track news and market sentiment

D-Wave’s share price is heavily influenced by the news. Investors should watch for:

Quantum breakthroughs

Government contracts or research grants

Partnership announcements with international companies

Even competitor advertising can indirectly affect D-Wave’s rating due to industry benchmarking.

Risks and Challenges Investors Must Consider dwave share price

Although the potential is huge, the risks is still high:

Technological uncertainty: Quantum computing solutions are still at the commercial stage. Some projects may not generate immediate returns.

Guess what? Market , Market Volatility: Share prices can fluctuate wildly based on news or hype rather thn financial results.

Competitive Pressure: Companies such as IBM, Google and Rigetti , Rigetti are developing parallel quantum technologies, that could limit their market share.

Economic factors: A broader market downturn or technology slowdown could affect investor confidence and share price performance.

And oh yeah, Investors should conduct thorough research and consider short-term volatility and long-term growth potential.

Seriously, Realistic effects of dwave share price technology

Understanding the practical impact of D-Wave quantum computing helps explain investor interest:

Logistics optimization: Companies like Volkswagen are using , using D-Wave to improve traffic and supply chain efficiency, demonstrating real benefits.

Health applications: Researchers are exploring quantum algorithms for drug discovery and protein folding that could revolutionize medicine.

Financial Modeling: Banks and hedge funds are testing D-Wave systems for portfolio optimization and risk , risk analysis, demonstrating commercial application outside of technology labs.

These applications are the main drivers of investor optimism as they indicate the possibility of monetization in addition to experimental research.

Expert Insights on dwave share price

Financial and technical experts often emphasize the following:

D-Wave is a high risk, high return investment…

Success depends not only on technological achievements, but also on scalability and marketing.

Like, Long-term investors may benefit , benefit when quantum computing becomes mainstream, but patience is key.

Like, According to market analysts:

“D-Wave’s value , value is more tied to its technology ecosystem and industry partnerships than traditional revenue , revenue metrics. Investors should focus on adoption trends and strategic collaborations.”

Conclusion

dwave share price represents more than just a stock, it reflects the growing promise of quantum computing. While , While volatility and uncertainty is inherent, D-Wave’s innovative technology, strategic partnerships and expanding commercial applications make it a company worth watching for long-term investors.

Seriously, By understanding market drivers, monitoring news and considering practical applications, investors can make informed decisions about future market entry. You know what? Quantum computing may not yet dominate industries, but D-Wave’s contribution and early adoption will give it a foothold in the next trillion dollar technology market.

Investors should balance optimism with , with caution, leveraging a long-term view, industry insight and strategic diversification to navigate the unique dynamics of this emerging sector.

FAQs

1… Seriously, What is the current price of D-Wave shares?

Seriously, D-Wave’s stock price fluctuates frequently due to market sentiment and news. And oh yeah, Check official stock sources for real-time updates.

2. Is D-Wave a good investment?

It depends on your risk taking , taking ability. D-Wave is suitable for high-risk, high-reward and long-term technology growth focused investors.

You know what? 3. What factors influence D-Wave’s share price?

You know what? Key factors include technology breakthroughs, industry partnerships, market perception and competition from , from other quantum , quantum companies.

And oh yeah, 4. You know , know what? How does D-Wave compare to competitors such , such as IBM and Google?

D-Wave focuses , focuses on quantum matching, while IBM and Google focus on gate-based quantum computing. Each approach has unique applications that influence investor opinion.

5. You know what? Can D-Wave technology impact industries today?

Yes. Like, From traffic optimization and logistics to finance and healthcare, D-Wave technology is already , already offering practical solutions, attracting the interest of investors.

Also Read This: Unleashing the Best of msn uk money: Your Ultimate Guide