Introduction

tm1 share price has recently attracted the attention of investors closely following trends in emerging market and mid-cap stocks. Like, In today’s rapidly changing financial environment, understanding a company’s stock price is not just about numbers, but also about market sentiment, business performance and future expectations.

a bunch , bunch of retail , retail investors look to TM1 stock price updates to gauge , gauge whether a stock fits their short-term trading strategy or long-term investment goals.Stock , Stock prices often reflect how much confidence investors have in a company’s financial health, management decisions, and the state of the industry. TM1 is no exception. You know what? The movement of its shares highlights how external factors such as economic conditions, sector , sector growth and corporate announcements can affect , affect the behavior of prices.

Guess what? Instead , Instead of blindly following daily fluctuations, smart investors analyze trends, trading volume, and historical patterns.This article explains the TM1 stock price in a clear and practical way, helping readers understand what drives its movement and how to interpret it wisely.

Table of Contents

Understanding Stock , Stock tm1 share price

The TM1 share price represents the MARKET value that investors are willing to pay for one share of a company. This value changes continuously during trading hours due to buying , buying and selling activity.

You know what? Its movement is made up of a bunch of basic elements:

Investors’ confidence in the company’s growth

Financial results and earnings updates

, updates

Industry and sector performance

Broader stock market sentiment

When positive news hits the market, demand , demand increases, pushing the price up. On the other , other hand, uncertainty or poor performance can lead to selling , selling pressure

Why Share Price Matters to Investors

A TM1 stock quote is not just a trading number; This , This is a financial signal. Investors use it to assess market sentiment and timing opportunities.

For example:

A price increase can indicate strong demand and optimism

A stable price ofen , often reflects balanced expectations

A falling rate can indicate caution or negative sentiment

Understanding these signals helps investors avoid emotional decisions and focus on strategy.

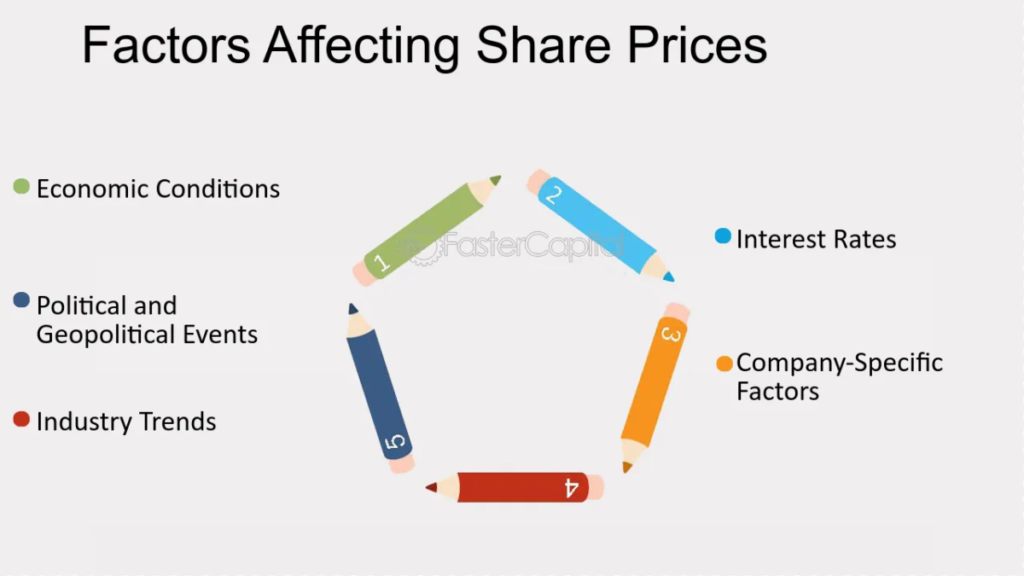

The main factors affecting the tm1 share price

The company’s financial performance

One of the strongest factors affecting the price of TM1’s shares is the company’s financial situation. And oh yeah, Revenue , Revenue growth, profit margins and cash flow reports directly influence investor confidence.

Guess what? When TM1 announces consistent earnings growth, the share , share price often reacts positively. However, set targets or lower profits may lead to temporary or long-term reductions in prices.

Market and economic conditions

Broader economic conditions also , also play a large role. Interest rates, inflation and general stock market trends can affect , affect TM1’s stock price even if the company itself is performing well.

For example, during market downturns:

Investors is moving towards safer assets

Mid-cap and growth , growth stocks may come , come under pressure

Trading volume may increase due to uncertainty

These are external factors, but they are very influential.

tm1 share price Trends and Volatility

Stock price volatility refers to how often a stock moves sharply up or down. And oh yeah, The TM1 share price may fluctuate due to the following:

Quarterly results announcements

Major company decisions or expansions

Changes in investor sentiment

Volatility is not always negative. Active , Active traders often see it as an opportunity, while long-term investors see it as a test of patience.

Like, Example of a price operation

Let’s say TM1 reports , reports strong quarterly results with improved revenue. And oh yeah, The share price may rise sharply in a short time due to increased buying interest. It may stabilize later as investors reassess its long-term value.

This pattern is common and highlights the importance of understanding price behavior from , from emotional reactions.

Guess what? How investors analyze tm1 share price

Investors use technical and fundamental methods , methods to evaluate TM1 stock price.

Like, A technical perspective

Technical analysis focuses on price charts, trends and trading volume. Common comments include:

Support and resistance levels

, levels

Price , Price momentum patterns

Short and long-term trends

These , These tools help traders identify entry and exit points.

Fundamental Perspective

Fundamental analysis examines the company behind the stock. Guess what? Investor study:

Business model , model and competitive advantage

Consistency of earnings

Future growth plans

By combining the two approaches, investors get a clearer , clearer picture of where the TM1 stock price may be heading next.

Short-term expectations vs. long-term expectations

TM1 share price can mean different things depending on your investment goals.

Like, Short-term traders focus on:

Daily or weekly price movements

Market news and mood

Quick profit opportunities

Long-term investors focus on:

Business sustainability

Industry growth potential

Value creation over time

Neither approach is wrong; Success , Success depends on clarity , clarity and discipline.

Guess what? Risks related to tm1 share price movements

All stocks carry risk, and the TM1 stock price is no exception. You know what? Although price movements can create opportunities, investors are exposed to uncertainty if decisions are made without proper analysis.

You know what? One common , common risk is overreacting to short-term news. Sometimes simple , simple updates or rumors lead to sudden price swings that don’t reflect the company’s actual performance. Investors who panic during selling may suffer unnecessary losses.

Like, Another , Another risk comes from market-wide corrections. Guess what? Even strong companies often see their , their share prices fall when the broader market turns into negative territory. In such cases, the fundamentals of TM1 may remain stable, but external pressure will temporarily affect the exchange rate.

You know , know what? Understanding these risks helps investors stay calm and avoid , avoid making emotional trading decisions.

Role of News and Announcements

Company announcements play a decisive role in the evolution of TM1’s stock price… Guess what? These announcements may include earnings reports, management changes, partnerships or future expansion plans.

Positive publicity often leads to:

Increase investor interest

High trading volume

High prices in the short term

Negative or unclear updates can cause hesitation and sales pressure. However, not all advertising leads to long-term effects. Smart investors distinguish between short-term hype and meaningful developments.

Seriously, An example of the news effect

If TM1 announces a new strategic initiative aimed at long-term growth, the share price may rise initially. Guess what? Over time, the market will evaluate whether the initiative will bring results. Seriously, If performance meets , meets expectations, price stability follows; Otherwise, a correction is made.

This , This demonstrates the importance of patience when analyzing stock price reactions.

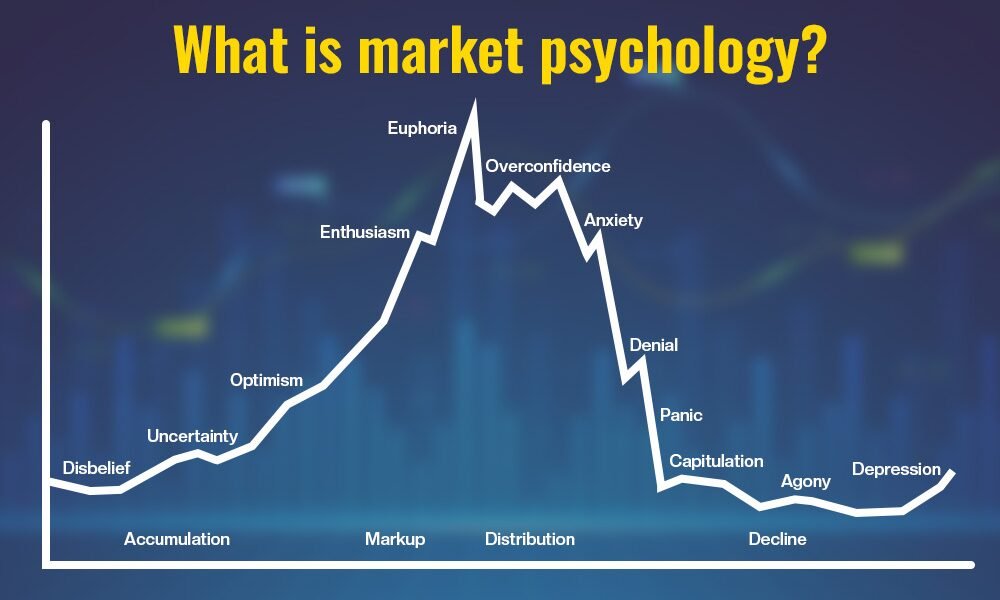

Like, tm1 share price and Investor Psychology

Investor psychology is often underestimated but it strongly influences prices. And yes fear and greed greed can affect TM1 stock price just like finance.

do you know When prices continue to rise investors fear being left behind and buy aggressively. This can push the price higher than its true value. And oh yeah Conversely during a recession fear spreads quickly leading to heavy selling.

Experienced investors recognize these emotional cycles and avoid the hype. Guess what? Instead , Instead they rely on research and discipline.

Effective tracking of tm1 share price

Regular monitoring of the TM1 stock price helps investors stay informed but continuous monitoring without a strategy can be counterproductive. The goal IS not to track all price movements but to understand trends.

Effective follow-up includes:

Review past flood data

Track volume patterns

Watch for key support and resistance levels

, levels

Long-term investors can check prices weekly or monthly while traders monitor them frequently.

Guess what? Use price trends wisely

, wisely A continued upward trend over time may indicate growing confidence in TM1’s business model. A sideways trend often indicates market uncertainty. Recognizing these patterns prevents impulsive behavior.

Comparing tm1 share price With Peers

One useful approach is to compare TM1’s share price performance to peers in the same sector. This comparison provides context and highlights relative strengths or weaknesses.

You know what? If TM1’s share price continues to rise while its peers struggle, it could indicate a competitive advantage. If peers outperform TM1, investors may question the growth potential or market position.

Such comparisons help investors make balanced decisions rather than relying on isolated data.

Long-term value against daily tm1 share price fluctuations

Daily price changes often attract attention, but even more important is long-term value creation. The TM1 share price may FLUCTUATE due to temporary factors, but the fundamentals of the business determine its long-term direction.

Investors who only focus on the daily , daily movement are missing , missing out on bigger opportunities. Long-term success often comes , comes from holding quality stocks through volatility while regularly reassessing fundamentals.

And oh yeah, This mentality separates informed investors from speculative traders.

Practical advice for investors watching the stock tm1 share price

Investors can improve their decision-making process , process with a structured approach:

Avoid making decisions based on rumours

Focus on company performance instead of hype

Diversify investments to reduce risk

Review your investment goals regularly

These habits encourage discipline and reduce emotional stress.

Future expectations regarding tm1 share price

While , While no one can predict the exact , exact price levels, the future of the TM1 stock , stock price depends on consistent performance, strategic execution and market conditions. Companies that adapt to change and maintain transparency tend to win the trust of investors in the long run.

Seriously, Instead of trying to time the market, investors benefit more from understanding the direction of the business and aligning investments with , with personal goals.

Conclusion

TM1’s share , share price is more , more than a number on a screen it reflects market , market confidence business strength and investor expectations… By understanding the factors that influence price movement investors can make informed and rational decisions instead of reacting emotionally.

Like Short-term volatility is part of any stock’s journey but long-term value depends on fundamentals and strategy. Whether you’re a trader looking for opportunities or a long-term investor focused on growth a clear and patient analysis of the TM1 stock price is essential.

An informed approach turns uncertainty into opportunity and helps investors navigate the market with confidence.

Also Read This: Best princess lilibet hair: Fascinating Royal Style