Introduction

visa inc share price is one of the largest global payment technology companies known for its extensive network and strong financial services. Over the years, Visa has become synonymous with digital payments, connecting consumers, merchants, financial institutions and governments around , around the world.

You know what? Understanding Visa Inc’s stock price is crucial for investors as it reflects not only the company’s performance, but also trends in the broader financial and payments industry.For example with advances in technology economic changes and consumer spending patterns Visa stock has shown resilience and growth. Like Stock prices fluctuate depending on market trends quarterly earnings reports regulatory developments and global economic conditions.

Like Whether you’re a long-term investor or a short-term trader being informed about the factors affecting visa inc share price is essential to making informed decisions. You know you know what? In this article we review recent trends influencing factors past performance and case , case studies to understand Visa Inc.’s stock price. You know , know what? Right.

Table of Contents

Seriously do you know , visa inc share price and market presence

Visa Inc. (NYSE: V ) operates in more than 200 countries and processes billions of transactions annually. guess? And oh yeah The company does not directly issue cards but provides the technology and infrastructure that enables financial institutions to offer credit debit debit and prepaid cards. Seriously Seriously your income comes primarily from , from transaction fees service fees and data management fees.

Like, Main features of the Visa business model

Visa’s business model is highly scalable as it focuses on transaction processing rather than lending. Some of the key features include:

Global Reach: The Visa network includes millions of merchants and financial institutions around the world.

Seriously, Increase in transaction volume: Revenues are increasing as more consumers switch to electronic payments instead of cash.

Like, Technological innovation: Visa invests heavily in secure payment systems, mobile wallets and artificial intelligence-based fraud detection.

Like, Partnerships: Collaborates with fintech startups and major banks to increase their market share.

Like, This , This model allows Visa to maintain high profit margins and stable revenues, that , that is often reflected in its share price performance.

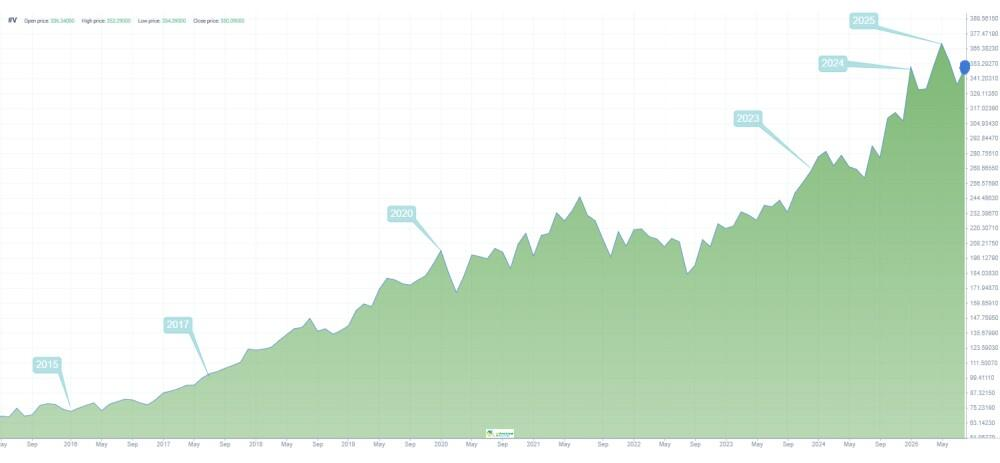

Historical visa inc share price Performance

Visa’s share price history shows significant growth since its 2008 IPO, when shares hovered around $44… Despite market volatility and the economic downturn, Visa , Visa stock has generally trended higher thanks to continued revenue growth and a strong , strong market position.

Like, The most important parameters influencing the share price

a bunch , bunch of events and trends have historically affected Visa stock:

2008 IPO: Visa went public in the midst , midst of the financial crisis, offering investors a long-term growth opportunity.

Digital payments boom: The emergence of e-commerce and mobile payments has significantly increased Visa’s revenues.

And oh yeah, Global Economic Conditions: An economic slowdown may temporarily affect transaction volume, that may cause inventories to decrease.

Acquisitions and partnerships: Strategic acquisitions, such as Visa’s investment in fintech companies, often have a positive impact on investor confidence.

For example, in 2020, although the COVID-19 pandemic reduced consumer spending in the short term, Visa’s share , share price quickly recovered thanks to the accelerating adoption of digital payments worldwide.

Guess what? Factors , Factors affecting the stock visa inc share price

Understanding the drivers of Visa stock is essential for investors making informed decisions. These factors are:

Economic and market conditions

Visa’s share price is sensitive to global , global economic conditions. During periods of economic growth, consumer spending increases, that increases the volume of transactions and has a positive impact on revenues. Seriously, Conversely, during a recession, spending cuts can slow growth, causing stock price fluctuations.

Consumer behavior and digital payments

The shift from cash to digital payments is an important driver of growth. Mobile wallets, contactless payments and online transactions are increasing Visa’s transaction volume. Guess what? For example, the use of contactless payments in the US increased by more than 150% between , between 2019 and 2022, directly driving , driving Visa’s revenues.

Guess what? Regulatory changes

Financial regulations can affect visa inc share price operations worldwide. Regulatory scrutiny of transaction fees, data security and cross-border payments can affect revenues and therefore share prices. A recent example of this is the European regulation limiting interchange fees, that temporarily put pressure on Visa shares.

You know what? Technological innovation and safety

visa inc share price investments in technology, cybersecurity and AI-driven payment solutions not only protect consumer data, but also attract institutional investors. Continuous innovation ensures shareholders that the company can maintain its competitive advantages, that positively affects stock performance.

Recent Trends in visa inc share price

Visa’s share price has shown different trends in recent years influenced by macroeconomic factors and industry-specific developments.

2021-2022: During the post-pandemic recovery card use increased significantly increasing Visa’s share.

2023: Rising interest rates and inflation lead to short-term market volatility temporarily affecting stock , stock prices.

Global expansion: Visa’s expansion into emerging markets remains a long-term driver of growth.

Visa’s performance against competitors

When comparing visa inc share price to competitors such as Mastercard or American Express Visa often maintains a higher market capitalization DUE to its wider transaction network and stronger global presence. Guess , Guess what? For example:

| Company | Market Cap (2025) | Notable Strengths |

| Visa Inc | $520B | Largest global network, strong brand |

| Mastercard | $360B | Strong in consumer loyalty programs |

| American Express | $140B | Premium cardholder focus |

This comparison illustrates why investors closely monitor Visa’s share price relative to its competitors, as it often reflects broader market confidence in the payments sector.

Practical Insights for Investors

Investors interested in Visa Inc should consider both short-term and long-term factors.

And oh yeah, Long-term investors focus on Visa’s continued revenue growth, market dominance and technological innovation.

Like, Short-term traders monitor quarterly earnings reports, interest rate , rate trends and global economic indicators that can affect stock price volatility.

Tips for monitoring Visa Inc stock price

Track quarterly earnings to understand revenue and transaction growth.

Like, Track , Track global spending trends, especially in the e-commerce and travel sectors.

View regulatory announcements in key markets such as the US, EU and Asia Pacific.

Seriously, Compare performance with , with competitors to gauge market position.

Guess , Guess what? Risks related to the visa inc share price

Investing in visa inc share price, Visa is not without risk. Understanding these can help investors make , make informed decisions:

Economic slowdown

Visa’s profit depends on the volume of transactions… do you know An economic recession, a decline , decline in consumer spending or a high unemployment rate , rate can negatively affect earnings and stock prices.

do you know Regulatory pressure

Governments around , around the world regulate financial services fees and security and privacy standards. Seriously, Tighter regulation could impact Visa’s profitability, particularly in regions like Europe where interchange fees , fees are capped.

Competition

Visa faces competition from Mastercard, American Express, fintech companies and cryptocurrency startups. And yes, innovations such as cryptocurrency payments or peer-to-peer applications can disrupt traditional card networks, affecting market share.

Seriously, currency fluctuations

As a global company, Visa generates revenue in multiple currencies. Guess what? Seriously, fluctuations in exchange rates and prices , prices can affect reported earnings and indirectly affect stock prices.

Examples of visa inc share price movements

Impact of COVID-19

During the first months of the COVID-19 pandemic (March-April 2020), Visa’s share price temporarily fell due to reduced spending and travel restrictions. But seriously, by mid-2020, the shift to online payments had accelerated, and Visa’s stock had risen sharply, highlighting its resilience.

One example is the effect OF rising interest rates

In 2022-2023, rising , rising global interest rates led to market volatility. Visa shares fell in the short term as investors anticipated a slowdown in economic growth, but long-term fundamentals remained strong and the stock rose as consumer spending stabilized.

Seriously, these examples show that while short-term fluctuations are normal, Visa’s strong , strong business model often ensures long-term growth.

Conclusion

Visa , Visa Inc. remains a dominant player in the global payments industry. Seriously, Share , Share prices reflect not only company performance, but also , also broader trends in technology adoption, consumer behavior and economic conditions. Investors should monitor economic indicators, digital , digital payment trends and regulatory developments to make informed decisions.

With its strong , strong market presence, innovative technology and strategic partnerships, Visa is suitable for long-term growth. While short-term market volatility and regulatory pressures pose risks, the company’s historical resilience suggests the share price has strong upside potential.

do you know Investors looking for stability, long-term returns and exposure to the digital payments sector , sector may find Visa stock an attractive option. However, its necessary to take into account risk factors and diversify investments in order to mitigate possible market uncertainty.

Like, Frequently Asked Questions About Visa Inc Stock Price

What , What is the current , current stock price of Visa Inc.?

A: The stock price fluctuates daily based on market , market conditions. You can view real-time updates , updates on financial platforms such , such as Yahoo Finance or Bloomberg.

You know what? Seriously, second question: does Visa pay dividends?

A: Yes, Visa pays a quarterly dividend and has grown steadily over , over the past decade.

And yes, the third question: How might economic changes affect Visa stock and the stock price?

A: Economic growth , growth leads to increased consumer spending and increased transaction volume, while recession or inflation can temporarily reduce , reduce income and affect stock values.

You know what? Seriously, Q4: Is Visa a good long-term investment?

A: Historically, Visa , Visa has shown consistent growth, making it a strong choice for long-term investors, especially those looking to enter the digital payments sector.

Guess what? Question 5: What risks should investors consider when using Visa?

A: Key risks include economic slowdowns, regulatory changes, competition from , from fintech and cryptocurrencies, and currency price fluctuations.

Also Read This: Best baillie gifford us growth trust share price