Introduction

The goldman sachs share value, stock often piques the curiosity of investors, analysts, and everyday market , market watchers—and for good reason. Goldman Sachs is not just another financial institution; its one of the most influential investment banks , banks in the world.

The value of its shares not only reflects daily market movements, but also represents trust, performance, strategy and global economic direction.Seriously, From , From advising governments to managing multi-billion dollar mergers,

Goldman Sachs is at the heart , heart of global finance. Because of this, the performance of its stocks , stocks is closely related to interest rates, economic cycles and investor sentiment. When markets rise, Goldman Sachs often thrives.

Table of Contents

Understanding goldman sachs share value as a company

company Founded in 1869, Goldman Sachs Group Inc. is a global financial powerhouse. The New York-based company provides investment banking, asset management, securities trading and financial advisory services.

Unlike traditional retail banks, Goldman Sachs focuses heavily on institutional, corporate and government clients.

Core business areas that create value

The value of a company’s stock is directly related to how well these sectors perform:

Investment banking , banking – advising on mergers, acquisitions and capital raising

Global Markets – Trade stocks, bonds, currencies and commodities

Asset and wealth management – Money management for institutions and high-net-worth clients

Platform solutions – Digital banking and FinTech initiatives

Sectors react differently to economic conditions, that explains why shares of Goldman Sachs rise sharply in strong markets and fall , fall in times , times of uncertainty.

What Influences goldman sachs share value

The value of Goldman Sachs shares does not change randomly… It responds to specific financial and economic signals that investors watch closely.

Economic cycles and interest rates

Interest rates play a big role in shaping Goldman Sachs’ profitability. You know what? When prices rise:

Trading activity often increases

Invetment banking fees may fluctuate

Credit margins may improve

However, interest rates that is too high could slow down deal-making, that could put pressure on stocks.

Guess what? Market fluctuations goldman sachs share value

Unlike consumer banks, Goldman Sachs often benefits from market fluctuations. Sharp market movements can lead to increased trading volume, that can lead to increased earnings. For example, in times of global uncertainty, institutional clients rely more heavily on Goldman , Goldman Sachs for risk management and advisory services.

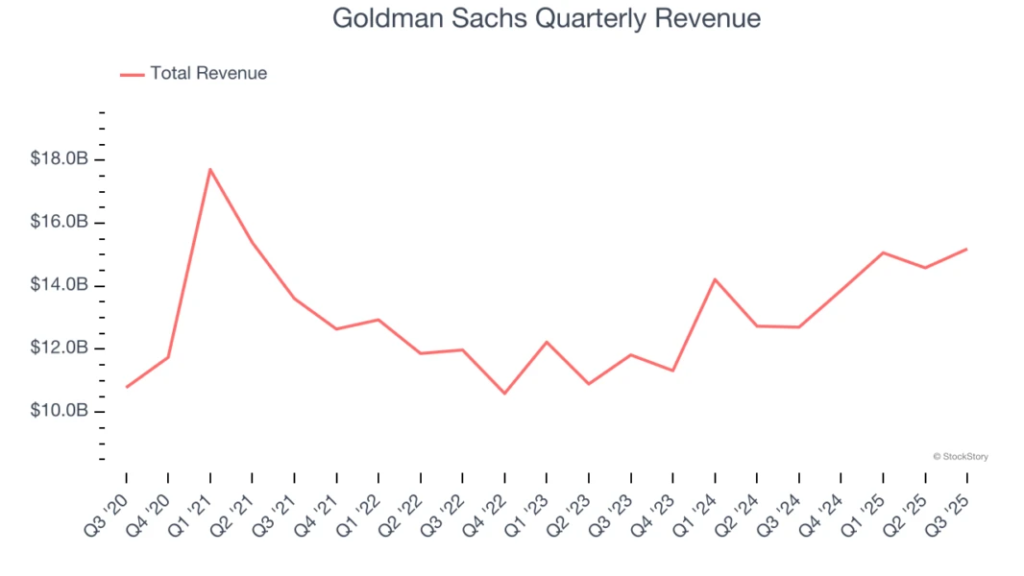

Income reports and guidance

Quarterly earnings are a defining moment for a stock. Investor Analysis:

Revenue growth across business segments

Cost control and efficiency

Forward-looking guidance from management

Even strong earnings can send shares down if expectations fall short.

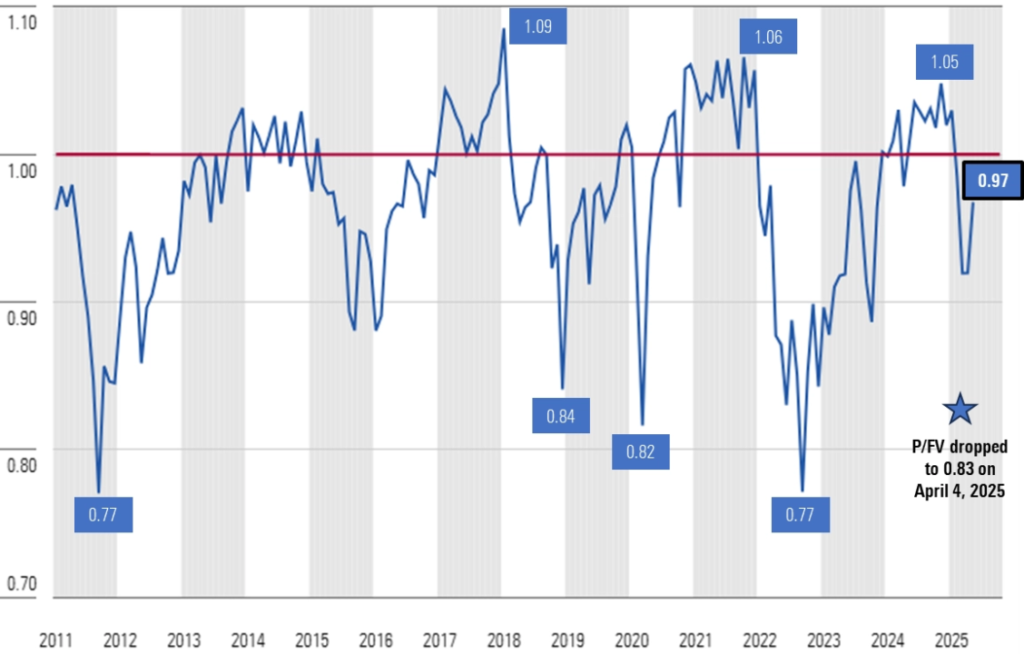

Historical lecture: a practical perspective

Examining past performance helps explain how the value of Goldman Sachs stock has behaved over time. Historically the stock , stock has shown:

Strong long-term growth potential

Short-term sharp fluctuations

Close connection with global financial activity

An example from the real world

During periods of economic recovery such , such as after a financial recession Goldman , Goldman Sachs often recovers faster than a group of traditional banks. This is due to the reopening of capital , capital markets the resumption of mergers and higher trading volumes that directly benefit , benefit the company.

Like , Like On the other , other hand in times of crisis the value of your , your shares can fall rapidly due to declining trading and market concerns even if the company remains fundamentally strong.

Investor sentiment and institu tional confidence goldman sachs share value

Investor perception is just as important as financial performance. Goldman Sachs is closely watched by large institutional investors because , because it often acts as a bellwether for the financial sector.

The positive signs supporting the value of the stock are as follows:

Credibility of leadership and clarity of strategy

Strong risk management practice

Global income diversification

Negative headlines regulatory pressure or unexpected losses can quickly affect confidence – even if the underlying business remains solid.

Like Why is the value , goldman sachs share value important to investors?

Stocks are often used as a benchmark to understand broader market trends. Like When Goldman Sachs does well it usually signals optimism in the capital markets. If you’re struggling it could reflect declining economic confidence.

For long-term investors the appeal is:

Exposure to global financial growth

Strong brand reputation

Able to adapt to changing market conditions

However this is not a low-risk stock. Its value can fluctuate strongly based on world events so its more suitable for knowledgeable and patient investors.

Risks That Can Impact Goldman Sachs Share Value

While the value of Goldman Sachs stock has strong long-term appeal its not without risks. Understanding these , these risks helps investors avoid emotional decisions and see the big picture.

Regulatory pressure

As a global investment bank Goldman Sachs , Sachs operates under strict regulations. Changes in banking laws capital , capital requirements or compliance rules may affect profitability.

For example the stricter regulations:

Increased operating costs

Limit certain high-risk trading activities

Reducing flexibility in global markets

Even rumors of regulatory action , action can affect stock prices before any actual impact on earnings becomes apparent.

goldman sachs share value, Global economic slowdown

Goldman Sachs relies heavily on deals trading and capital markets. During the economic slowdown:

A decrease in mergers and acquisitions

IPO activity is slowing down

Corporate spending has become cautious

This , This directly affects , affects revenue streams and can temporarily depress the value of shares – even if the company , company remains financially sound.

How leadership strategy shapes engagement performance

Management decisions play a strong , strong role in building investor confidence. Goldman Sachs management has consistently focused on diversification to reduce dependence on a single source of income.

And oh yeah Transition to stable incomes

In recent , recent years the company , company has expanded with the following:

asset , asset management

Digital financial platforms

This strategy aims , aims to balance the ups and downs of high trading income. You know what? Investors often respond positively to such long-term planning that supports the value of Goldman Sachs stock during uncertain times.

Cost Discipline and Efficiency

Operational efficiency is just as important as revenue growth… Goldman Sachs has taken steps to streamline operations, cut unnecessary costs and invest in technology.

These moves are:

Improving profit margins

Increase revenue consistency

Increase investor confidence

When cost control is aligned with growth, stock value often responds favorably.

Compare , Compare goldman sachs share value s with other banks

One of the reasons investors are watching Goldman , Goldman Sachs closely is how different it behaves from traditional banks.

Investment bank vs. retail bank

Unlike , Unlike retail-focused banks that rely on consumer loans and deposits, Goldman Sachs makes its living from institutional activity.

The main differences are:

Greater sensitivity to market cycles

Higher profits in strong , strong markets

Greater volatility in times of uncertainty

This makes the stock attractive to investors who understand market , market timing and risk management.

Competitiveness

Goldman Sachs maintains a strong competitive advantage because:

Deep relationships with , with customers

Global reach

Experience in complex financial transactions

These strengths help protect the stock’s value even as competition intensifies.

Future Outlook: What May Drive Share Value Ahead

Looking ahead, a number of factors could affect the value of Goldman Sachs stock in the coming , coming years.

Technology and innovation

Investing in financial technology and automation is becoming increasingly important. And oh yeah, Goldman , Goldman Sachs continuously updates its systems to:

Improving trading efficiency

Improving data-driven decision making

Reduction of operational risks

, risks

These investments don’t necessarily bring immediate profits, but often increase long-term valuation.

Seriously, Expanding the global market

Emerging markets , markets and international capital flows represent an opportunity for growth. As global economies evolve, Goldman Sachs’ ability to adapt , adapt and expand can play a key role in maintaining the stock’s appreciation.

Stability of interest rates

A more predictable interest rate environment generally supports consistent deal , deal making and investment activity. If markets balance out, Goldman , Goldman Sachs could benefit from continued earnings momentum.

Is goldman sachs share value Suitable for Long-Term Investors?

The answer depends on your investment goals and risk tolerance…

And oh yeah Who can benefit the most?

Guess what? This , This kit can fit:

Investors are comfortable with market volatility

Those , Those who want to serve global finance

Long-term shareholders focus on economic cycles

Who should , should take care?

Seriously It may not be ideal:

Short-term traders , traders who don’t know the market

Risk-averse investors seek stability

Those who don’t know the dynamics of the financial sector

, sector

Understanding these factors is crucial before making , making any investment decisions.

Conclusion

The value of Goldman Sachs stock reflects much more than the daily movement of share prices – it represents the pulse of global finance. And oh yeah Driven by market cycles management strategy economic conditions and investor sentiment the stock tells a broader , broader story about confidence in capital markets.

Guess , Guess what? Goldman Sachs remains , remains a powerful force in the financial world able to deliver strong growth in favorable conditions and resilience in difficult times. Like While volatility is part of the ride , ride its global reach strategic sophistication and financial expertise continue to support long-term value.

For informed investors who understand the risks and rewards Goldman Sachs offers more than just shares but an insight into the workings of the global , global financial engine.

Also Read This: Faibloh: The Best Digital Trust Framework